What it will take to defeat TurboTax

February 2021

Jesse Wilson once said to me:

“What if we could give customers a button. They’d press it at the end of the year and it would automagically file their taxes for them.”

At the time I thought the idea was appealing, but didn’t think much more about it. Today, I think this is the way TurboTax gets dismantled. It’s taking consumer finance companies with massive distribution, combining them with a tax preparation API and real-time visibility into users tax position. Tackling TurboTax head on is probably a waste of money. Tackling TurboTax asymmetrically has a real shot.

TurboTax is functionally a monopoly

From the outside looking in, TurboTax has a near impregnable moat. In taxes, there’s no clear second player with near the level of distribution, automation, community, trustworthiness, brand recognition and regulatory capture that they have. They’re incredible at playing regulatory defense by constantly and subtly opposing any government efforts to simplify taxes[1], which simultaneously makes their product more valuable and raises the bar for new entrants. Even the Justice Department recognizes TurboTax as a functional monopoly, and forced Intuit to sell CreditKarma Tax in order to complete the acquisition.[2] They’re also strong at sniping competition early, before it becomes a serious threat. GoodApril is an example; the company went through TechStars in 2013 and was focused on tax planning, initially for gig economy workers. Intuit acquired them before demo day, pre-empting their Series A.[3]

More recently, from the outside looking in, you’d think they missed CreditKarma Tax by acquiring Credit Karma and selling the tax business to Cash App. I think more likely, CK gained scale before threatening Intuit by launching the tax product. The acquisition was at least valuable for a) securing CK’s distribution for TurboTax’s use and b) reducing the likelihood that a good competitor would emerge. You might bet that Cash App successfully executes on the transaction, but it’s at least not a guarantee, from Intuit’s perspective.

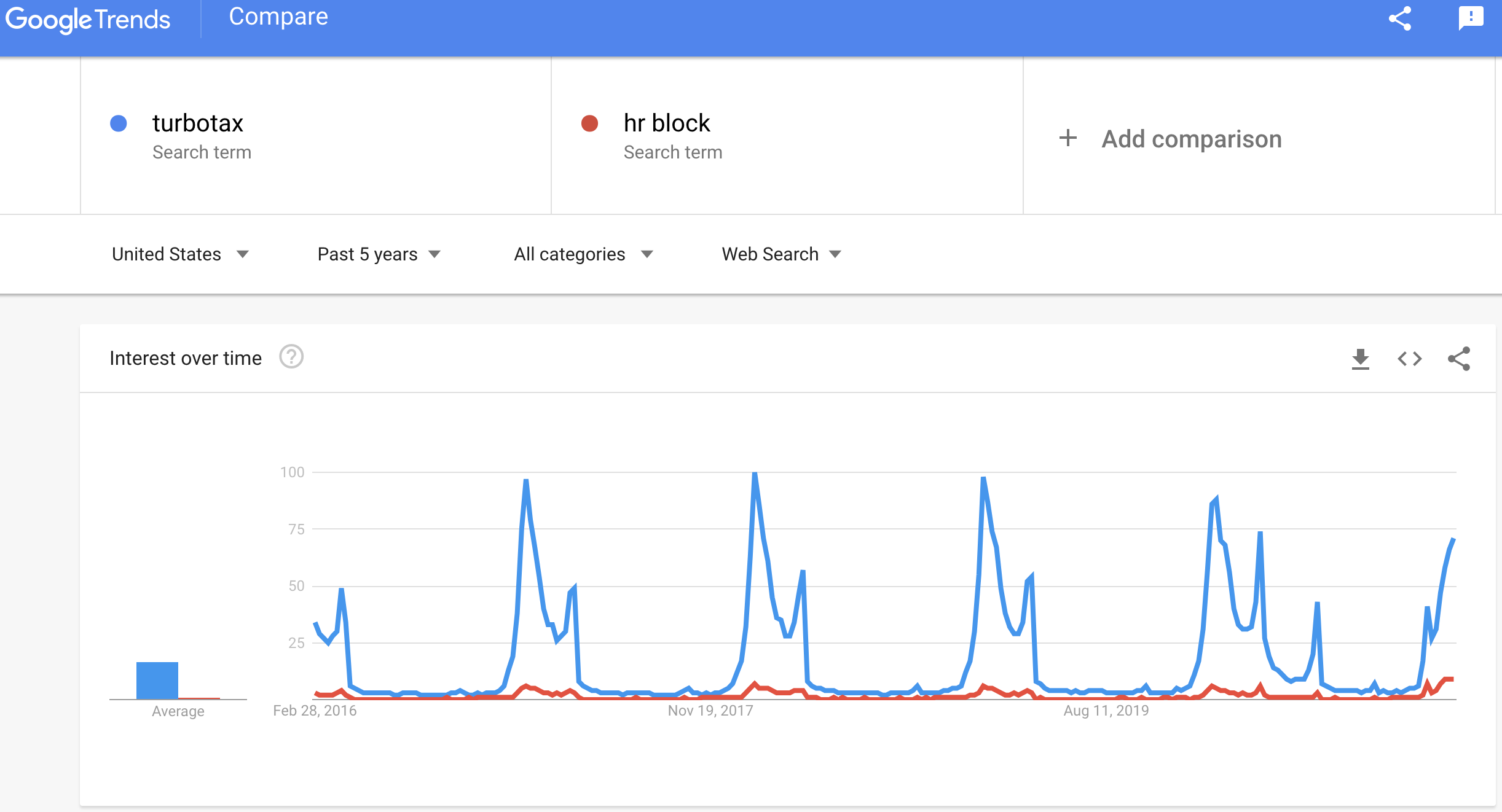

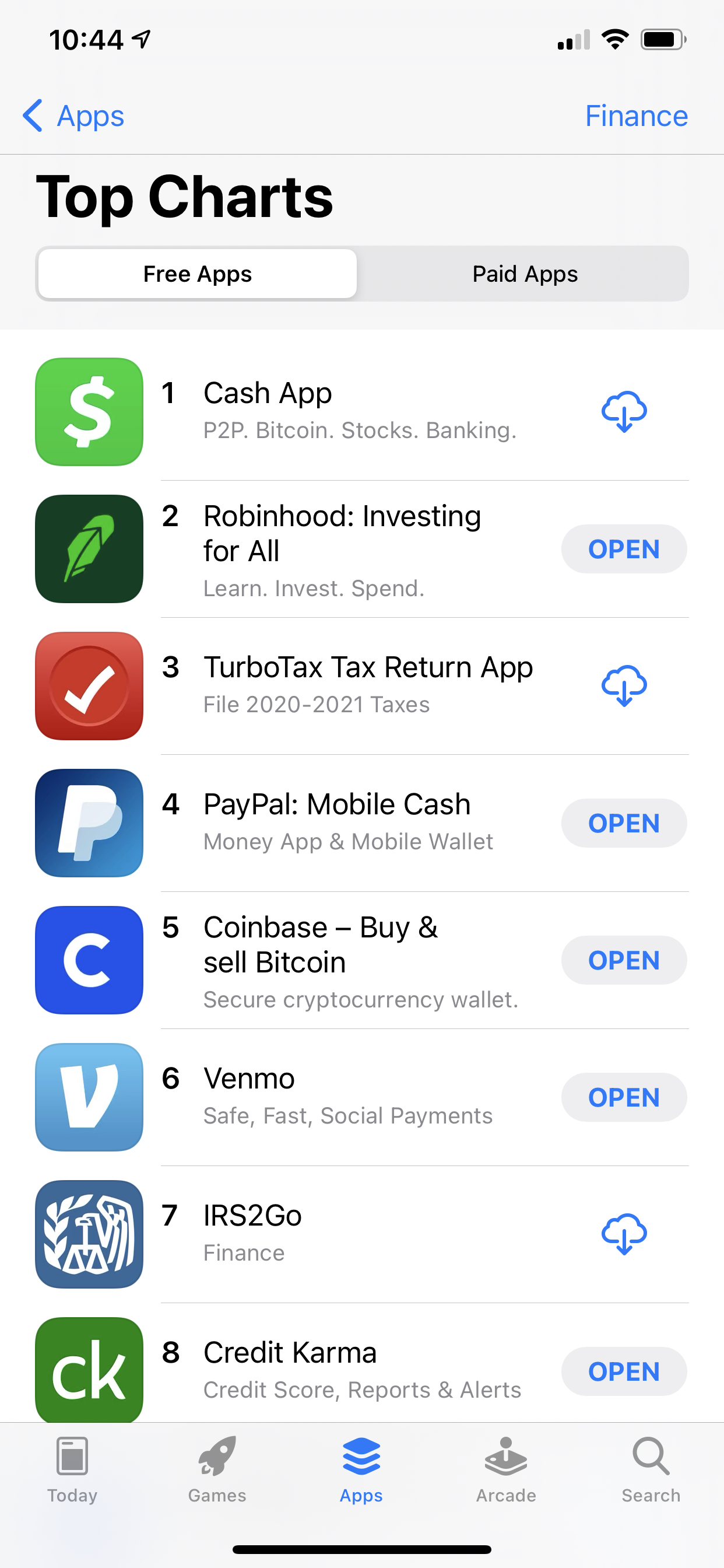

TurboTax also owns the namespace for consumer taxes. Every year between January and April they become the top finance app and a top 10 app in the US Appstore. It’s possible someone builds a better direct to consumer product focused on tax prep, but I’m skeptical.

All things considered, I think TurboTax is a fantastic business, and will be tough to compete with head on. It’s more likely that the following pieces come together to obviate TurboTax.

Consumer finance distribution + tax prep API + differentiated tax planning (eg real-time tax computation)

The challenge

Unseating TurboTax has been hard historically for a few reasons.

Superb distribution

As a startup, you have a 3.5 month window every year to acquire tax customers. During tax season, TurboTax already dominates the organic acquisition, Appstore rankings and paid acquisition channels. They’ve been doing it for years, they’re probably quite efficient, and you’re not going to outspend (or smartly out acquire) Turbotax from New Years day to tax day. [4]

Perception & Quality

Doing taxes well for mainstream consumers is complicated, and the consequences of getting them wrong are both bewildering and material. Every year the tax code gets more complex. This benefits the player who already has internally encoded the complexity, and for whom additional complexity is incremental rather than absolute (starting from 0). Simply put, you have one shot to build customer trust, and if you get it wrong you really screw up the customer’s life. Why would any consumer take that risk?

TurboTax has been doing your taxes for years, already has your previous filings, and will use them to prefill tons of fields for you. All the while, you’ve probably never been audited. It just works.

It’s time to build (tax prep software)

To defeat TurboTax, a lot of the ingredients exist already. They’re just in the process of being assembled.

Consumer Finance Distribution

To defeat Turbotax, you need consumer distribution that’s as good or better than what TurboTax has. Without this, they’ll outspend you on customer acquisition every tax season, long before you can make a dent. It helps to already have established consumer trust with an adjacent offering, because if the only benefit of your product is tax preparation, you’ll be forced to acquire customers during tax season and compete head on, and you’ll be outspent.

Today, multiple consumer finance products already have the distribution necessary to compete. These include products like Cash App, Chime, Venmo, Robinhood and others, which have wide ranging customer trust and customer bases in the tens of millions each. Crucially, these products acquire customers upstream of tax season - they provide financial services to consumers all year around. They also already have a partial picture into a customer’s financial life, and they’re already thinking about customers’ tax needs. Cash App has taken a first party approach (by buying Credit Karma Tax).

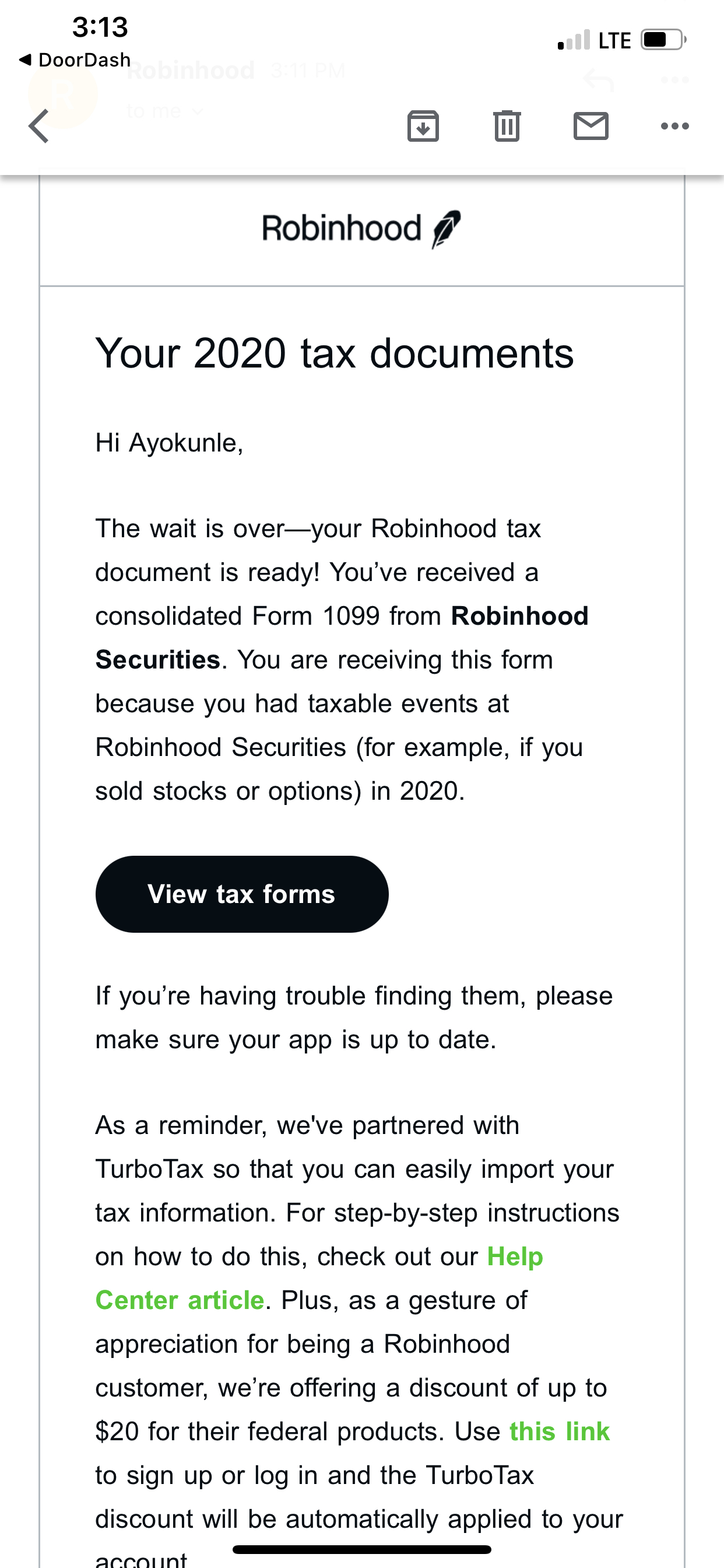

Robinhood has taken a lead gen approach (by partnering with TurboTax). No one’s built on a tax API (because none currently exist). [5] For TurboTax this will be death by a thousand cuts - it will be years before a single player files more taxes than TurboTax. But the top 5 neobanks can drain enough volume to have a material impact.

Differentiated Tax Planning: Real time tax position

Turbotax is insanely focused on consumer tax needs during filing season. To date, this has been sufficient to win. Over the last 18 months, however, “new” things are possible around taxes that weren’t before. Today, high quality income and tax withholding data is available via API. With this data, you can compute your tax position in real time at any point in the year, which has two core financial benefits; a) you can know your tax liability at any point in the year with reasonable precision, and b) with that knowledge, you can optimize it. For instance, you could build a continuous W2 with Pinwheel’s paystubs endpoint.

This financial benefit wasn’t possible before the last couple of years, and it’s outside of TurboTax’s wheelhouse, because TurboTax optimizes and monetizes the tax transaction at year end, and essentially re-acquires taxpayers each season. Outside of tax season, I basically don’t log into TurboTax.

Over the last couple of years, several companies have emerged that provide programmatic, API based access to high quality income and wage data for consumers, including Pinwheel (where I’m invested), Argyle, and Atomic. I suspect Plaid's deposit switch team will eventually offer this as well. Any consumer finance company can now provide a few foundational benefits to customers:

- Building the customer’s tax forms (eg W2 or 1099) continuously throughout the year using their payroll data

- Providing the user a rolling, real-time view of their tax position (taxes owed, refunds) as they earn and spend throughout the year

- Trust from the customer that you’re the right company to help file their taxes at year end. At year end - customers press a button, answer some qualifying questions, and electronically file the taxes

On top of these foundational benefits, there’s even more financial benefits that can be built. These are less straightforward, but no less valuable:

- Tax refund factoring; providing consumers access to refunds prior to tax season. There’s a bunch of regulatory complexity here and some fraud to account for, including users omitting crucial info to overstate their refunds.

- Tax optimization; recommending changes to income and spend behavior to improve year end tax liability positioning. This already happens a lot at the high end through concepts like tax loss harvesting and smb expense write offs; it’s just rarer for regular W2 and 1099 earners. In today’s world, by the time you’re logging into TurboTax, you’ve missed any shot at optimizing your tax position. Optimizations include amounts to save in tax advantaged accounts like HSA’s and 401Ks, tax allowances you’re eligible for, etc.

- Spend categorization for tax purposes; paired with an issued card, you can help categorize transactions and suggest which to save receipts for at year end. Mint and other PFMs focus on transaction categorization for budgeting; no one’s really focused on it for personal taxes. [6]

- Advance capital gains optimisation; tax loss harvesting tools exist, but with where rates are now there are interesting package strategies to allow customers finance instead of selling assets.[7] This starts with creating a live Schedule D and some scenario analysis tools which show customers their alternatives to getting cash today.

At its heart, this approach reaches the customer for a tax use case upstream of when TurboTax acquires them. This means a) you’re not competing at the time of year when TurboTax’s acquisition dollars will drown you, and b) you’re acquiring the customer mid-year, before taxes consume their attention. The best time to optimize your taxes are long before you have to pay them, and neobanks are well placed to provide this benefit.

What’s missing: tax preparation as an API

Today, there are lots of companies providing tax filing APIs, that would allow a tax preparer electronically file taxes that have already been prepared. From what I can see, no one’s building an API that manages the preparation of taxes. At a minimum you need a system that

- takes the various inputs (1099, W2 etc) and computes a tax position asks a series of leading questions to learn more about the consumer (things like whether you’re married, head of household etc) to improve the tax computation

- Assembles the aggregated data into a consolidated tax filing and submits it electronically

- Optionally you could have a human accountant review for errors prior to filing

- Optionally, an API for tax transaction categorization; submit card spend or ACH transactions and the API returns categorization for tax purposes, amount that can be written off, HSA/FSA eligibility, and so on. This can be built on top of a service like Ntropy.

With all the developments in financial services over the course of 2020, this is a missing piece of financial services infrastructure today, and would find instant product market fit if it existed. When available, this API would enable neobank teams to prepare and file taxes for cardholders, thus becoming more sticky and improving LTVs. Whoever didn’t have it would be at an immediate disadvantage when trying to steal customers from those who did.

Combine this with the distribution, technical chops, and ambition of neobank products today, and TurboTax is in trouble.

Notes

[1] Propublica had a long read on this, here: https://www.propublica.org/article/inside-turbotax-20-year-fight-to-stop-americans-from-filing-their-taxes-for-free . I’m generally a believer that we know less than we think, but the evidence in it was pretty damning, and you can’t argue with incentives.

[2] The Justice Department pushed for the divestment because the acquisition would reduce competition: https://www.justice.gov/opa/pr/justice-department-requires-divestiture-credit-karma-tax-intuit-proceed-acquisition-credit

[3] I distinctly remember reading the Hacker News comments when the acquisition happened. It’s when this thread first came to mind: https://news.ycombinator.com/item?id=6185927

[4] You can also read this as TurboTax recognizing the real distribution edge of neobanks, and co-opting them as channel partners. This will keep happening until an API exists that enables neobanks or mobile-first financial providers to file & monetize taxes directly.

[5] In Fiscal Year 2020 Intuit spent ~$2B in on marketing expenses. If marketing spend is proportional to revenue by segment, that's ~$820 million on consumer marketing you’ll be competing against. Source: https://s23.q4cdn.com/935127502/files/doc_financials/2020/q4/FY20-Form-10-K-r262-As-Filed-08-31-20.pdf

[6] To build spend categorization for taxes your API request would take {amount, type, merchant name, merchant category, transaction date} and would respond with {tax deductible amount, HSA eligibility, expense category} etc. Tax accountants already run this algorithm in their heads. You'd just be automating it.

[7] One example of this is the pledged line of credit product that tons of brokerages offer: https://www.schwab.com/pledged-asset-line. I hadn’t heard of this before the last couple of years but I assume it was commonplace for wealthy clients. Today, even Coinbase has a portfolio backed loan product: https://blog.coinbase.com/borrow-cash-using-bitcoin-on-coinbase-4fa9bbbc9100 . In all likelihood, these products are one endpoint of an extended zero interest rate environment, but at the end of the day they have the same effect; as a consumer, you no longer have to sell liquid assets (stock or crypto in this case) to benefit from capital appreciation, which has massive implications for the distribution of tax liability;

Thanks to Temi, Femi, Jim Esposito, Jesse Wilson, Kurtis Lin, Yoni Rechtman, Lauren Myrick, & Justin Overdorff for reading this in draft form.

To get notified when I publish a new essay, please subscribe here.