Children of Durbin

The blast radius of the Durbin Amendment

February 2022

The Wall Street Reform and Consumer Protection Act, better known as Dodd-Frank, passed in 2010 in the shadow of the financial crisis. The Durbin Amendment was part of Dodd-Frank, and was passed to limit the fees merchants paid to banks for debit card processing (commonly called interchange). The regulation applied to banks with over $10 billion in assets (essentially exempting smaller banks such as community banks, who have a strong distributed lobby around the US).

Intended Consequences

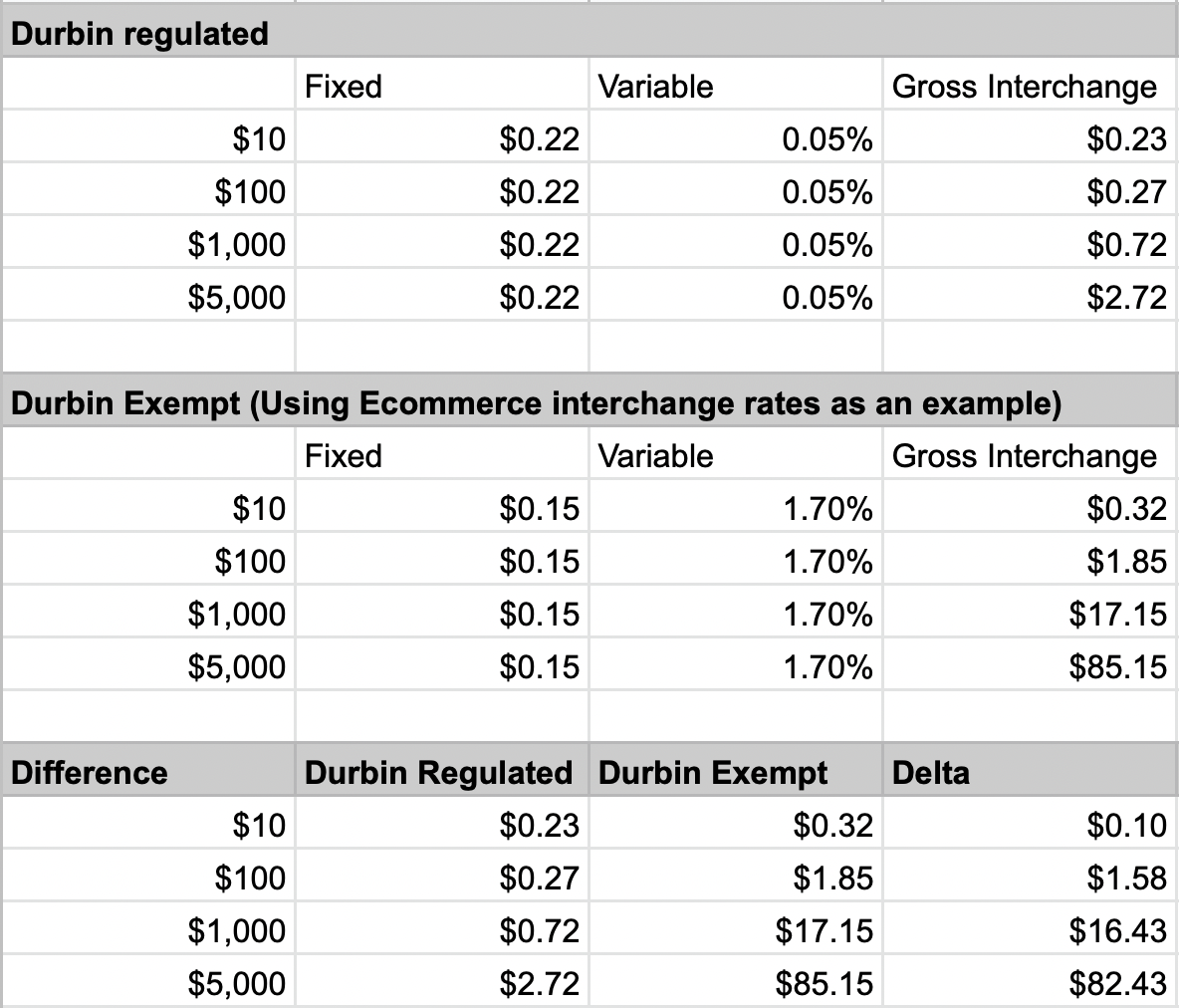

When Durbin went into effect, it set a ceiling for debit interchange fees at 21 cents and 5bps of the transaction amount for regulated institutions (the implementation of certain fraud measures allowed banks to add a cent, so effectively Durbin regulated interchange is 22c and 5bps). Technically, card networks could charge any amount below the cap, but as commercially minded firms, Visa and Mastercard set interchange at the ceiling. This effectively split debit interchange into 2 tiers; Durbin regulated at 22c and 5bps, and Durbin exempt, which was effectively unregulated[1] and works out to somewhere around 120 - 160 bps depending on your transaction mix. Incumbent banks (Chase, BofA, Wells, PNC, Citi etc) made up 80% of debit cards issued, so the Durbin amendment materially cut the costs of debit card processing for merchants around the US. Early on, the mechanics worked as intended - Durbin regulated banks, which made up 80% of the debit volume in the US, saw their interchange revenue cut significantly. Practically what this means is, if you pay $5000 for an Airbnb with your Chase Debit card, Chase gets, ~$3, but if you pay for that same Airbnb with your Chime card, Chime gets ~$85. Exact amounts depend on how the transaction gets categorized and the specific agreement that issuer has with the card network, but the order of magnitude of the delta is correct.

To put this in perspective, in Q3 2011, just before Durbin went into effect, aggregate annualized debit interchange across the US banking industry was $19.9Bn. In Q4 2011, that same figure was down 7% at $18.5Bn, even when aggregate transaction count grew 11% during that same period. [2]

Unintended consequences

Banks make money off consumers by a mix of payment revenue (typically interchange, wire fees etc), net interest margin (the spread between what banks earn lending money and what they pay as interest on your checking and savings accounts) and other fees (monthly fees, dormant account fees, overdraft fees etc). Over the last 2 decades, as interest rates have hovered at all time lows, the mix of revenue from depository consumer banking has shifted heavily to payment & fee based revenue, and less on net interest margin. In addition, if you were a bank customer that lived paycheck to paycheck (or otherwise had high income and expense volatility) then your bank couldn’t rely on net interest margin to monetize you anyway, and relied much more heavily on fees.

The cost of legacy infrastructure

Coming into the last decade, most US banks had fairly high costs to service deposits, driven by legacy (often on-premise) infrastructure. For example (circa 2014), a bank that held balances on infrastructure provided by services like Fiserv, FIS or Jack Henry (treat these costs as directionally correct, rather than precise), would pay on average $3 per month for each account. So, regardless of whether an account was active, the bank paid $36 per year for that account. This didn’t include any other costs: shipping and processing physical checks, card manufacturing and fulfillment, fraud losses, and customer support costs, to name a few. This amount scaled linearly with each additional cardholder account (Eg if a cardholder had both checking and savings accounts, they’d cost that institution $72 instead of $36) at the same institution. Theoretically, banks could afford to play a cross-subsidy game, enabling high deposit customers to subsidize paycheck to paycheck customers. [3]

The true irony here is that incumbent banks were paying $36/year for something with a $0 marginal cost (a database table + eventstream).

Incumbent banks still have high infrastructure costs, because even though low cost infrastructure options exist, the transition is slow and tentative. This is driven by organizational drag and byzantine tech stacks. Imagine you manage the deposit programs at Wells and in 2022 you could either choose to migrate from FIS to Marqeta and cut your costs by 50% (just making these numbers up) or you could instead launch a voice assistant? If you get the Marqeta switch wrong, a bunch of customers’ cards won’t work and you lose a bunch of spend, and you’re losing your job. If you get it right, margins improve in a few years. You took a ton of operational risk to get there, and might not be around to reap the rewards when the full savings and flexibility are realized. If you launch the voice assistant someone will invite you to speak at Money2020. For personal career incentives, there’s not enough upside. Compounding this is that traditional card economics are complex to model and understand - as you’ll see in the Visa interchange fee schedules, you have to make a ton of assumptions about your transaction mix to understand the revenue impact, and even then, the cost side of the ledger is quite opaque.

A sea change in distribution

Lastly, this might sound obvious but, in consumer finance, distribution is king (this is still true today). Over the last hundred years, winning at distribution meant having more branches accessible to more consumers. By doing so, you’d capitalize on both increased foot traffic and more impressions (as each location serves as both an endpoint to sign up new customers, and a billboard to advertise your services). In the years since the iPhone launch in 2007, the growing ubiquity of smartphones, combined with the increasing depth & richness of mobile apps has turned branch based banking from a distribution advantage over the previous 100 years, to an operating expense liability[4] over the last ~10, which has dealt (and is still dealing) a triple blow to incumbent banks;

- app stores are a lower cost, underexploited mechanism for consumer finance distribution, than branches

- incumbent banks continue to pay for rent and headcount to maintain branches (and to a lesser extent, ATMs) and face headwinds when trying to close them

- mobile applications have gotten sufficiently rich & deep that the share of banking functionality that requires in person interactions gets lower everyday.

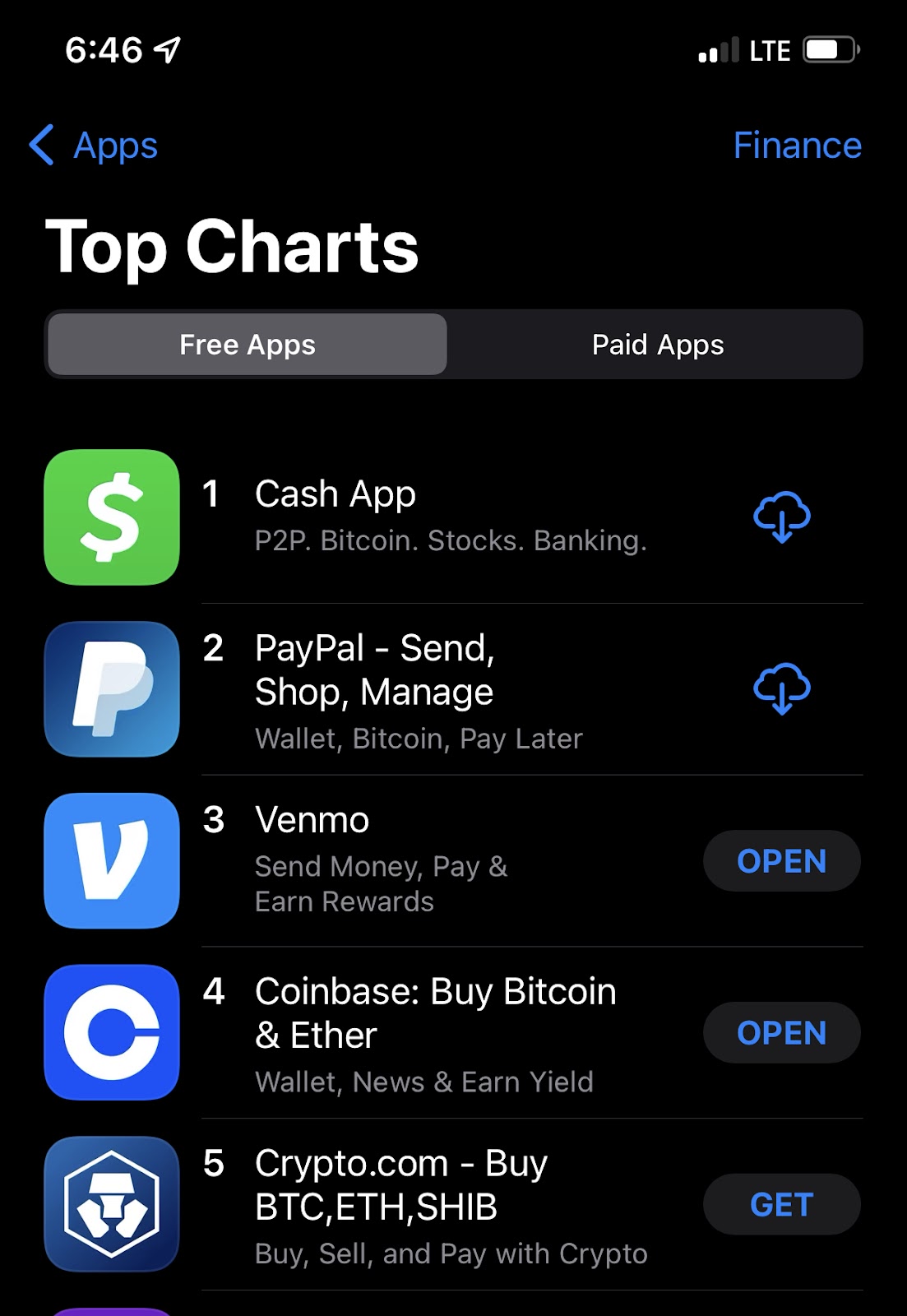

I can’t overstate the impact of #3; there just are simply not that many banking interactions for which a customer needs to be in person. The two I can think of that remain are 1) certified checks, when you need them and 2) mortgages which require wet signatures (fewer and fewer mortgages require these as time goes by). One early insight we had at Cash App was that if we could just be the number 1 finance app in the appstores, we’d get the digital equivalent of foot traffic; everytime someone navigates to the finance section, they’d see your app first. We also recognized (this came later) that if we could be a top ranked app (not just in finance), we’d get the digital equivalent of impressions; all the algorithms would pick us up as a top app, all the editors would include us in their lists, and everytime someone got a new phone for the holidays, as they browsed top apps to download, we’d show up.

This focus (on mobile as a distribution mechanism) was not exclusive to Cash App, but incumbents weren’t thinking about it (or at least weren’t behaving like it was existential). If you’re Jamie Dimon, making sure Chase is the #1 consumer finance app probably has never crossed your mind, even though Chase as an institution can basically serve every single consumer finance need to date (maybe except crypto, to the extent you consider that a “need”). At Cash App, we valued mobile so much that we sacrificed our web app; choosing to have insanely rich and deep mobile experiences, while our web/desktop presence was useful but minimal. After 2015, we basically never prioritized feature parity between web and mobile. This remains true today. There’s lots of operational consequences for this that aren’t worth getting into here, but this focus on mobile has contributed to Cash App being the #4 most downloaded app of 2021 in the US.[5]

Second Order Effects: Rise of the underbanked

Historically, banks could afford high legacy costs through a gigantic fee pool comprising all the sources above (payments, net interest margin and other fees). A sustained ZIRP [6] environment compressed net interest margin by making deposits less profitable, and the Durbin amendment caused paycheck to paycheck consumers to be unprofitable overnight. On net $14 billion in annual (mostly interchange) revenue evaporated for Durbin regulated banks[7] in the years after it went into effect. For Durbin regulated banks, acquisition, retention and reward spend on paycheck to paycheck consumers had to collapse.

Passing costs on to consumers via fees

One obvious way to offset the reduction in interchange revenue was to increasingly rely on overdraft fees. Overdraft fees existed prior to the Durbin amendment, but after 2011, banks increasingly relied on the practice of charging customers a large fixed fee whenever their balances dropped below $0, stacking those fees by enabling a customer’s transactions to continue to be approved even when their balance was below zero, and eventually (prior to the crackdown) re-ordering transactions that happened on the same day, so that the customer’s balance would drop below $0 earlier in the day, so the customer would incur multiple overdraft fees in that day. For example imagine you had $100 in your balance, and 4 transactions in that day, for $20, $15, $37, and $90, in that order. Banks using re-ordering, would process the largest transaction first ($90) so your balance would be at $10, and each subsequent transaction would drop your balance below $0, and thus incur an overdraft fee (on average about $35). So in the sequence they occurred, you’d pay $35 in overdraft fees and have a overdrawn balance of -$97.00. In re-ordered sequence, you’d pay $105 in overdraft fees, and have an overdrawn balance of -$167. To cap this off, between 2009 and 2013, overdraft fees increased 15% from an average of $25, to $30, with the largest banks pricing overdrafts at $35 per overdraft. [8]. Fortunately, overdraft re-ordering is basically extinct as it was one of the first practices the CFPB cracked down on after the agency was formed.

The acceleration of overdrafts (and other deposit fees) had a few consequences. First, they helped replace lost interchange revenue. Second, they removed the subsidy; customers with sufficient balances would be monetized directly via net interest margin, and wouldn’t incur overdraft fees. Customers with repeat overdrafts would have their accounts closed and (often) be sent into collections, and have their overdraft status reported to consumer reporting agencies like ChexSystems[9]. This would enable other banks to identify and decline affected customers when they attempted to open a checking account. Finally, customers who incurred overdrafts and actually paid them were sufficiently profitable to keep.

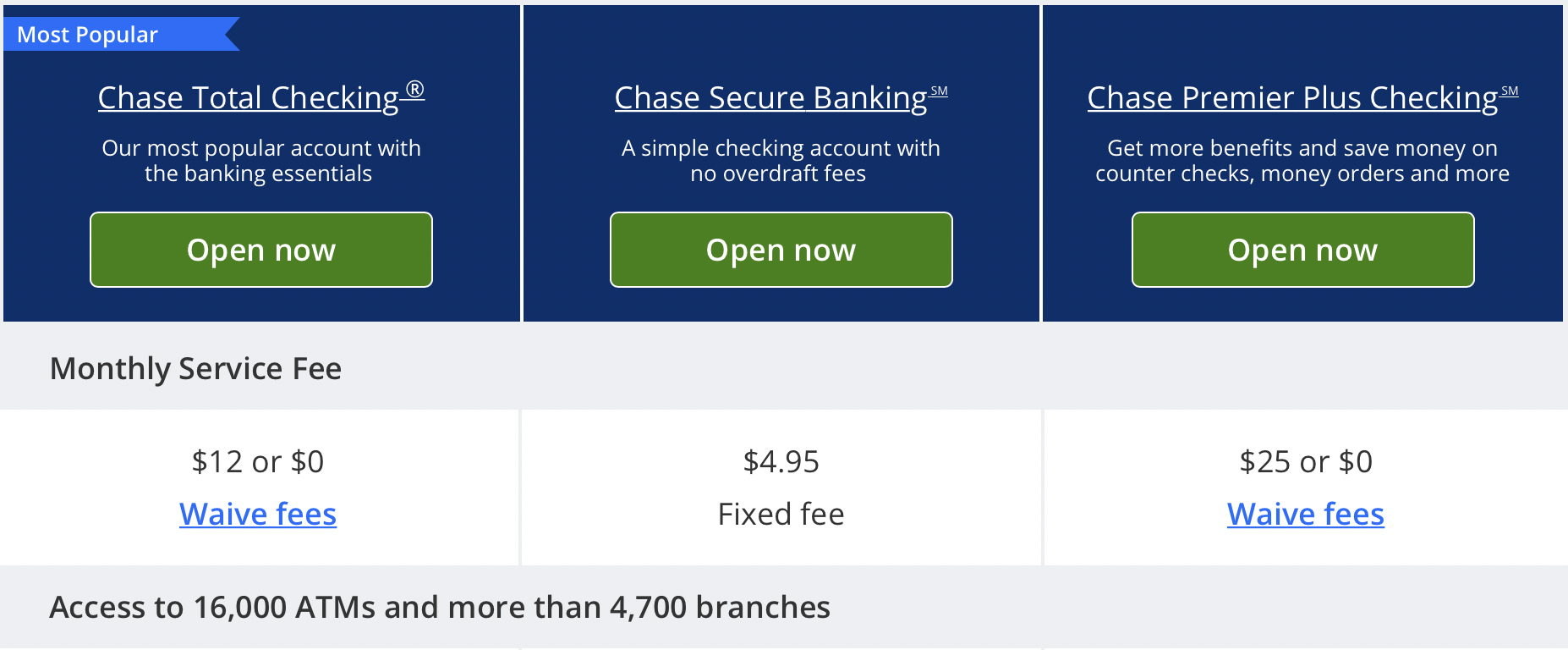

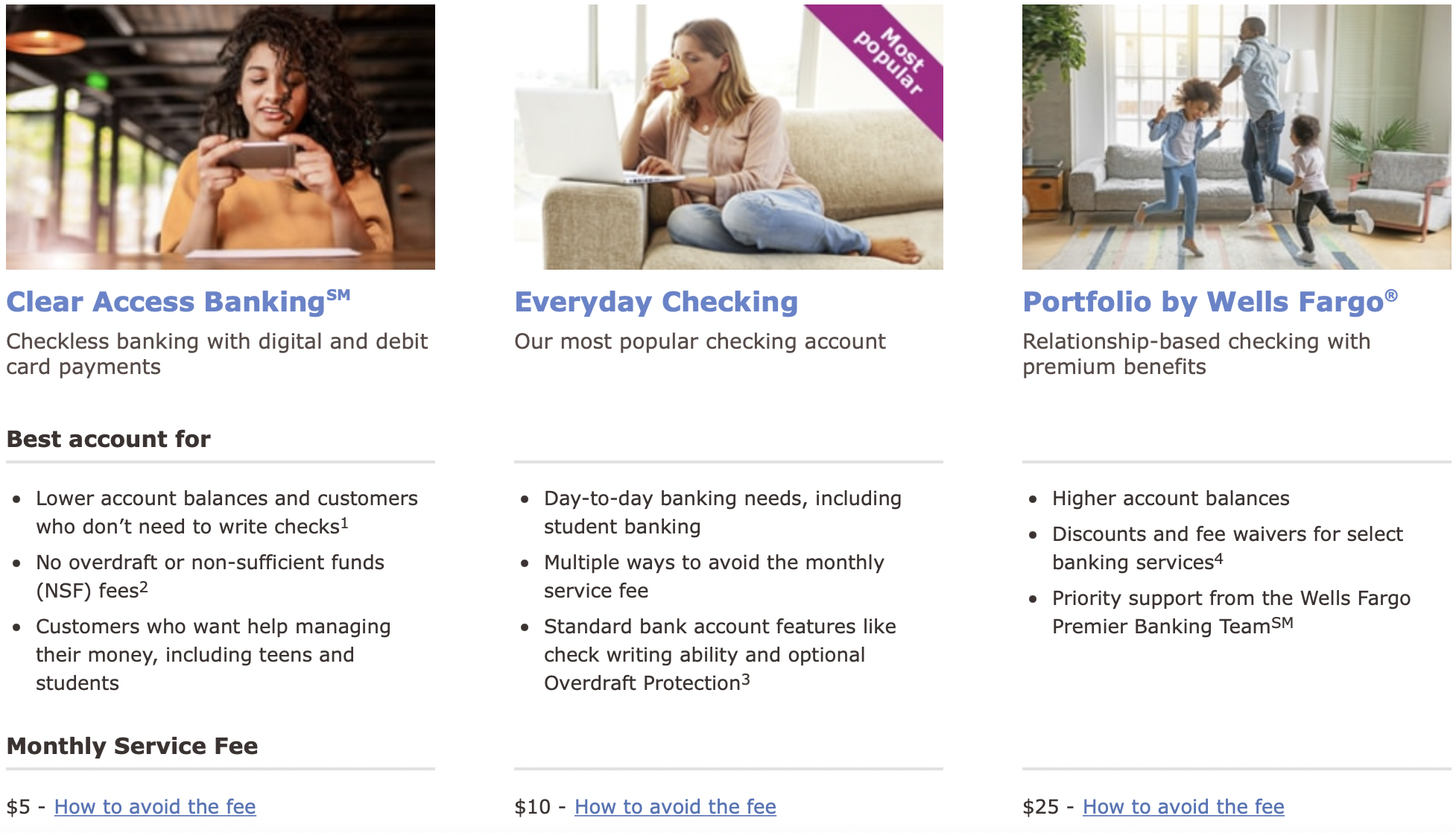

The other mechanism for recouping lost interchange fees was to introduce and enforce minimum balances and monthly deposit fees.

Chase Fees

Wells Fargo Fees  Again, deposit fees existed prior to Durbin, but the Durbin rollout increased bank’s reliance on non interchange fee structures. Overdrafts, account service fees, and minimum balances were often deployed together. You could maintain a minimum balance and point your direct deposits at the account, and you’d incur no deposit fees (by policy) and be really unlikely to incur overdraft fees. Or you could pay monthly service fees, keep a low balance, and run the risks of overdrafts. According to the Federal Reserve [7] changes in deposit fees were sufficient to only offset roughly 30% of the lost interchange income.

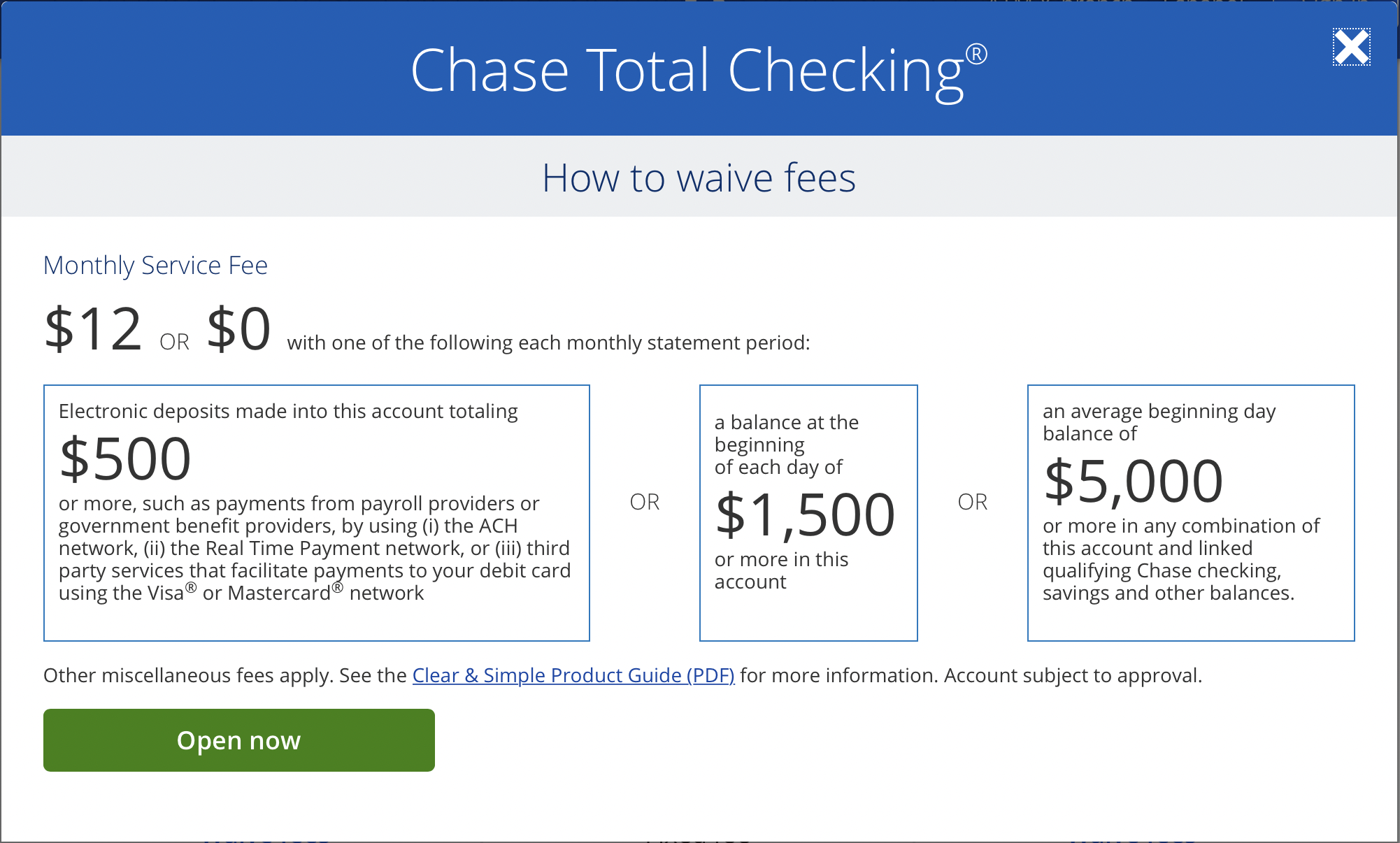

Again, deposit fees existed prior to Durbin, but the Durbin rollout increased bank’s reliance on non interchange fee structures. Overdrafts, account service fees, and minimum balances were often deployed together. You could maintain a minimum balance and point your direct deposits at the account, and you’d incur no deposit fees (by policy) and be really unlikely to incur overdraft fees. Or you could pay monthly service fees, keep a low balance, and run the risks of overdrafts. According to the Federal Reserve [7] changes in deposit fees were sufficient to only offset roughly 30% of the lost interchange income.

Macro Background

Durbin was passed in the shadow of the Great Recession and a multi decade long run trend of greater income and expense volatility for consumers. Regardless of whether Durbin had gone into effect or not, the reality is that for the last several decades, more and more American consumers live paycheck to paycheck every day and have less of a financial cushion. This structural long run trend makes them less likely to be bankable by Durbin regulated banks (or more likely to be monetizable via overdraft fees, depending how you want to look at it). There’s some evidence that this migration away from incumbent banks was already happening prior to 2011 - one study published in 2010 cites over 4 million consumers moving their bank relationships from “too big to fail” banks.[10]

Focus on a richer consumer

In addition to no longer being able to profitably bank this segment of customers, Durbin regulated banks stopped paying to acquire and retain them, and shifted acquisition and retention dollars to customers who would be surer bets. Tactically this meant - ad dollars, sponsorships and channels used to acquire paycheck to paycheck customers were drained of funding. Those dollars went instead to reducing the interchange hole, and to fund incentives of wealthier customers - those incentives would be designed to promote behavior that increased the odds a wealthier customer would stick around - such as Chase’s current $500 bonus to customers who stick around for 90 days and maintain a minimum balance of $5000. You’ll notice basically zero mass market neobanks use this as a tactic - they simply don’t have to.

Seeds of their demise

The combined withdrawal from marketing and retention channels and passing on fees to this segment dramatically expanded the underbanked/unbanked population that most consumer neobanks have been going after for years. Obviously there are other reasons for consumers to be unbanked, such as being newly immigrated or undocumented, but as wages have stagnated, fewer and fewer people meet the criteria to avoid $35 overdraft fees a few times a year. In many cases, they’re explicitly locked out by the consumer reporting agencies such as ChexSystems. This effect strengthened competition in unexpected ways.

Payment acquiring

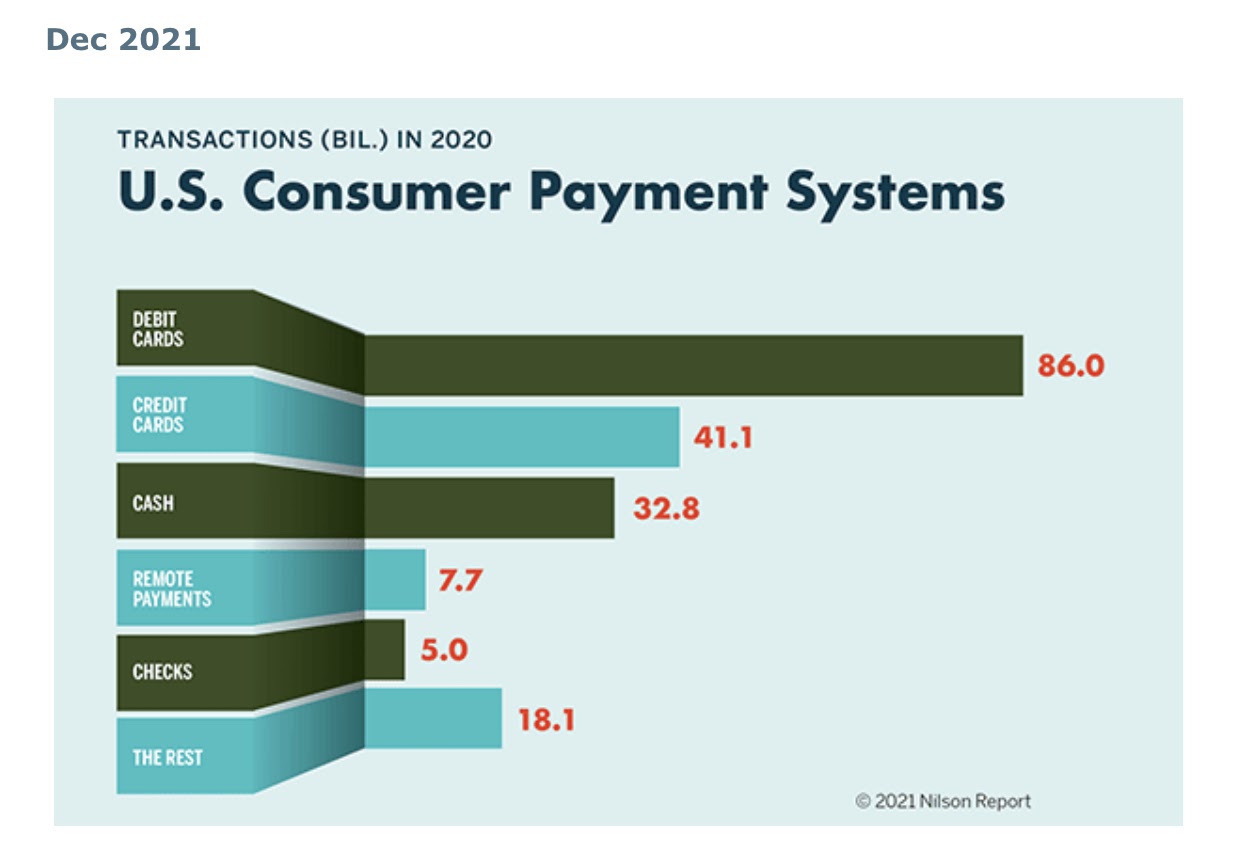

Square and Stripe were both started in 2009. Square focused on using mobile as an access point to expand card payments, and Stripe focused on internet payments. Square, Stripe and PayPal were early, large beneficiaries of the Durbin Amendment, for two reasons. First, they charged merchants stable take rates that abstracted away the complexity of interchange (as opposed to industry standard cost-plus). Second, they (naturally) processed a mix of debit and credit card payments, and 80% of debit card payments are on cards issued by Durbin regulated banks, and debit is a meaningful portion of the mix of card payments (for offline payments, debit is close to 60% of the mix both by volume and count.). Overall, debit is the single largest consumer payment method in the us.

These companies all charge merchants variable fees (2.75% in Square’s case, 2.9% in Stripe and PayPal’s case) as well as fixed, so when Durbin went into effect the proportion of their volume that was on debit expanded meaningfully in margin. Early in Square and Stripe’s history there was a perception that interchange was a bad business, margins would trend to zero, and these companies would need a second act in order to sustain themselves. While they’ve all had multiple acts at this point, that perception missed the fact that a regulatory change made interchange far more profitable for acquirers, and by focusing on onboarding new merchants into the ecosystem, they’d be much more able to sustain margins (vs trying to process for large merchants like Target and Walmart who already have large operations optimizing down their interchange costs with their payment acquirers).

Competition in consumer finance

Three types of consumer finance opportunities emerged post Durbin.

Overdraft Protection

First, companies like Dave, Earnin, and Brigit emerged to provide programmatic overdraft protection, extending working capital to affected consumers in exchange for predictable, lower fees. At launch, Dave charged $1/month and would extend $100 if your balance dropped close to zero, directly deposited into your account. As a consumer, you could choose to subject yourself to unpredictable overdraft fees, each averaging $35, or you could pay $12/yr and never pay an overdraft fee again. These companies used overdraft protection as a wedge, gained a meaningful amount of customer adoption, and have now expanded to a full suite of no fee banking solutions, built on top of Durbin exempt banks and funded by Durbin exempt interchange, thus arbitraging the regulation yet again.

Debit Card based P2P

Second, companies like Cash App, Venmo and PayPal relied on low Durbin regulated rates to fund card loads in the early days, prior to the Visa AFT (Account Funding Transaction) and the MasterCard MoneySend transaction becoming widely available. Durbin regulated rates provided a way for customers of P2P platforms to fund their digital wallets at much lower cost per transaction (to the platform) than Durbin exempt interchange, by linking a debit card. Debit still cost more than ACH, but debit pulls are simultaneously faster and more reliable. These products enabled customers to add funds to their digital wallets by linking a debit card. The platforms paid the (now lower) interchange fees on the 80% of debit card volume that were Durbin regulated. They all did it slightly differently: Cash app subsidized it directly, Venmo charged 3% for cards, and PayPal just took margin on commercial payments.

Consumer Banking

Finally, companies like Cash App, Chime, Varo, Sofi and others, all built no fee checking accounts in direct competition to incumbent consumer banks. This opportunity had the most leverage - paid CaC was lower for this opportunity because major banks had withdrawn from most paid marketing channels for this segment, and organic CaC was lower because of new distribution channels like mobile that were underexploited by incumbents. In addition, growing numbers of consumers were extremely distrustful of incumbents because of the predatory reputation of overdrafts. Finally, reliance on legacy infrastructure including on-premise technology and real estate forced incumbent banks to sustain high fixed costs to continue operating, while upstarts grew like weeds on technology stacks that were much more usage driven.

Funding alternative infrastructure

Once the second order effects are taken into consideration, it’s clear that rather than reducing merchant fees, the Durbin Amendment instead shifted a large portion of the overall interchange fee pool away from major banks. Neobanks arose around this fee pool, and in addition to funding these neobanks, it also funded new infrastructure players serving them. The top 5 finance apps in the AppStore all have debit programs issued on top of Durbin exempt banks, and none of them are issued on legacy card infrastructure (they’re all on newer BaaS providers).

The Durbin exempt fee pool has directly funded the development of new card issuing infrastructure including Marqeta, Lithic, Treasury Prime, Unit, Bond, Synapse, Adyen, Synctera and Stripe Treasury among others, as they’re able to participate in the interchange revenue by enabling new consumer neobanks to launch debit programs (and eventually credit and others). This fee pool also supports Durbin exempt banks such as community banks, who were the logical beneficiary of the exemption in the first place. In addition, by enabling these companies to scale, it’s helped fund other infrastructure that neobanks rely on, including account auth (eg Plaid), payroll APIs (eg Pinwheel, Atomic, Argyle) investing APIs (eg Drivewealth, Alpaca, AtomicVest), identity platforms (eg Alloy, Persona) and more.

Regulatory Risk

There have been a few attempts to reverse the Durbin Amendment since it was implemented. The Financial CHOICE Act of 2017[11] was the most prominent. It was passed in the House and never made it past the Senate, and it targeted several elements of the Dodd-Frank legislation, which the Durbin amendment was a part of. Politically I’m not sure what it would take to repeal the Durbin amendment or if it’s right or wrong. Tactically I think there are a few ways it could go.

Everyone is regulated

All debit interchange is capped at 22c + 5bps, with no exceptions. This would benefit merchant processors (Square, Stripe) because their processing costs drop, large merchants (Target, Walmart), digital wallets (Cash App, Venmo) that rely on debit cards to load cards and send p2p, and incumbent banks that are already regulated as it levels the playing field. It would hurt consumer neobanks (Chime, Cash Card, Varo, Sofi), BaaS providers, and community banks dependent on interchange for revenue. Hard to pull off politically as community banks are super distributed and have a really strong lobby.

Everyone is exempt

All debit interchange is set at unregulated rates, with no exceptions. Hurts merchants and merchant processors as their costs rise, and hurts p2p providers who would have to pay more for transactions or speed their transitions to RTP or Fednow, and hurts neobanks as their CaC and retention costs would rise as incumbent banks begin to compete for their customers. Benefits incumbent banks who are already regulated as they now again have access to the interchange fee pool for a large swath of Americans, on top of the overdraft fee pool that they’ve expanded materially over the last decade.

Regulatory interface changes to apply to program managers/marketers

Bank regulators in the US primarily interface directly with banks. This means, for example, that if a neobank did something wrong, and the FDIC was concerned, they’d still spend most of their time with the bank partner that was actually the regulatory entity. It also means that the Durbin Amendment was written to apply to “Issuers”[12]

This subsection shall not apply to any issuer that, together with its affiliates, has assets of less than $10,000,000,000, and the Board shall exempt such issuers from regulations prescribed under paragraph (3)(A).

And only a “bank” can be an “issuer”. As a result, a company that is technically a program manager, issues cards, and is the primary user experience for a consumer (like Chime) can have over $10b in assets, and the cards issued by that company will continue to be Durbin-exempt, as long as that company is not the bank. This is a kind of regulatory arbitrage - eventually there will be companies larger than incumbent banks in terms of assets, that benefit from Durbin exempt interchange.

Neobank exits are complicated

The Durbin Amendment has created a strange dynamic for interchange dependent consumer neobanks in the US; in order to survive, they have to go public. By acquiring Chime, Chase would destroy Chime’s business - either by becoming the bank of record for Chime customers and forcing Chime’s interchange revenue to be subject to Durbin (like the rest of Chase’s debit portfolio), or by maintaining Chime’s cards on the Bancorp, and effectively becoming a decoupled debit program, which is not eligible for the Durbin exemption[13]. This narrows the exit routes for American consumer neobanks, because the most deep pocketed pool of potential acquirers is basically closed to them. As a result it’s quite likely that the ones that survive will be a) formidable competitors, and b) public companies. By the way, I don't think this means they are bad companies - I just think those companies have to capitalize themselves thoughtfully.

A good question for many consumer neobanks in the US is; who will acquire them?

The infra & SMB opportunity for incumbents

All that being said, I think the most promising routes for incumbent banks to benefit from the second order effects of Durbin are via a) financial infrastructure providers and b) SMB focused neobanks. Financial infrastructure providers like Alloy, Persona, Middesk (in identity), Marqeta, Lithic, Unit (in card issuing) and others serve many consumer neobanks, are growing fast, and have business models that don’t depend on nailing consumer adoption. Incumbents could add utility, reduce friction or costs, or drive adoption by building on top of these new infrastructure tools. SMB neobanks have an edge; their interchange revenue is not within scope for Durbin, and they tend to have larger deposit pools on a per customer basis than consumer neobanks. Companies like Mercury, Brex, Nearside, Novo and Found have all benefited from mobile distribution, the added expectation that business can be done online, and the growth of low or variable cost infrastructure providers speeding up their go-to-market. I once tried to open a Chase business account - it took 4 phone calls, 2 faxes and one visit to a physical branch, in addition to applying online. For this reason, I suspect we’ll see an order of magnitude more fintech infrastructure and SMB neobank exits to incumbent banks, than consumer neobank exits.

The long game

To be clear, the Durbin Amendment is not the only reason driving the success of these companies and products. Even if Durbin had never passed, mobile would still be a new distribution channel, and new players would rise and would need modernized infrastructure. After all, the rise in neobanks has happened around the world, not just in the US. Revolut, Monzo, N26 and others all operate in Europe, where interchange economics are so low that they mostly monetize off foreign exchange and other fees. That being said, the Durbin Amendment has been a significant contributing factor, and the profitability of interchange has made a real difference in the strength and heft of American neobanks (vs. European ones for example). Now that these companies have grown up and scaled, nothing stops them from competing with major banks on their most profitable products; is there anything special that makes Chase so good at mortgages, that Chime could never learn? Maybe? But my guess is, companies like Chime and Cash App get good at mortgages and credit cards faster than Chase and BofA shed their branch footprints. I think the longest lasting impact of the Durbin amendment is the emergence of a distinct financial ecosystem that serves probably as many Americans as the major banks do, and will do so for a long time.

Notes

[1] Visa interchange tables here: https://usa.visa.com/content/dam/VCOM/download/merchants/visa-usa-interchange-reimbursement-fees.pdf

[2] Overdraft Revenue Begins to Rebound

[3] In practice, the subsidy often went the other way, with fees from low balance customers subsidizing richer consumers.

[4] The pandemic has really laid bare the true liability of branches. In March and April 2020 as much of the country locked down, there was about ~3 weeks during which no one could enter a branch. When 100% of financial activity shifted online, mobile first companies really benefited, and legacy banks still paid rent on branches. In person activity still hasn’t returned to pre-2020 levels, but banks still pay rent on branches. One additional confounding factor; banks have to navigate some political minefields when closing branches - the loss of financial access and jobs, particularly in remote or rural areas that are underbanked irks elected officials, so banks face enormous friction when they try to close branches.

[5] Forbes: Top 10 Most Downloaded Apps And Games Of 2021: TikTok, Telegram Big Winners

[6] Wikipedia: Zero Interest Rate Policy

[7] Bank Profitability and Debit Card Interchange Regulation: Bank Responses to the Durbin Amendment

[8] OVERDRAFT PRICE RISES TO $30 PER TRANSACTION

[9] ChexSystems, Inc

[10] https://www.congress.gov/bill/115th-congress/house-bill/10

[11] https://www.law.cornell.edu/uscode/text/15/1693o-2

[12] Federal Reserve Releases Final Rule to Implement the Durbin Amendment

[13] Over 4 Million Move Their Accounts From Wall Street Banks in 2010

Thanks to Aaron Klein, Justin Overdorff, Amias Gerety & Jim Esposito for reading this in draft form.

To get notified when I publish a new essay, please subscribe here.